do nonprofits pay taxes in canada

Do nonprofits pay payroll taxes. Not-for-profits generally do not pay corporate income tax or file an Ontario corporate tax return but they do have to meet some requirements under Canadas Income Tax Act.

Benefits Of Bookkeeping Bookkeeping Accounting Finance

This exemption applies only to income tax.

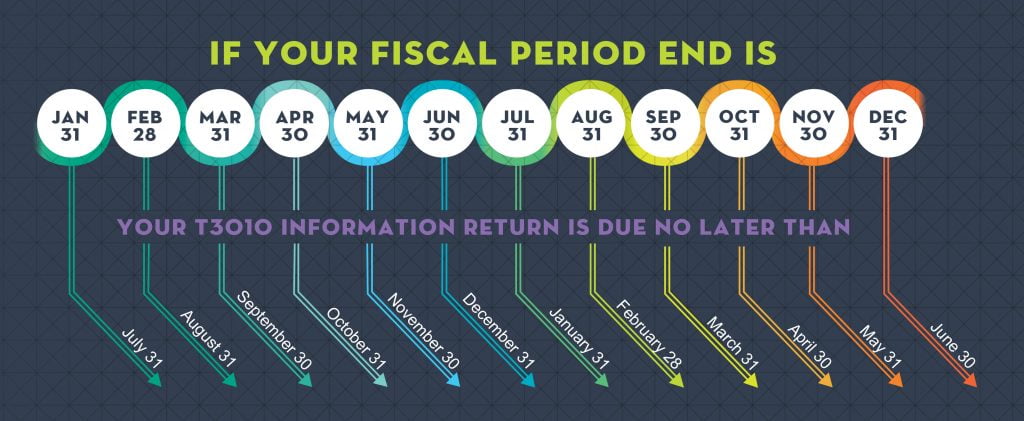

. A Canadian nonprofit would not need to pay income tax but they have to use the Canada Revenue Agency in filing their returns. There are differences between these types of organizations. Canada Revenue Agency issues an annual return in order for nonprofits to file.

Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual impairment. Charities and not-for-profits ought to ask themselves whether property taxes apply to them in light of this. Nonprofit tax filing requirements vary based on the type of organization the value of the organizations assets and other factors.

As long as you itemize your deductions you can generally claim 100 percent of your church donations as a deduction. If your NPO has received or is eligible to receive taxable dividends interest rent or royalties worth more than 10000 you. Religions Denominations pay the mths Pay Income Tax In Canada.

Once accepted a registered charity is exempt from income tax under paragraph 1491f. Tax time can be stressful for nonprofit and charitable organizations in Canada especially when the filing requirements are not well understood within the organization. Do nonprofits pay taxes in canada Saturday March 12 2022 Edit.

In accordance with the type of nonprofit organization the value of its assets and other factors nonprofit organizations must file. An NPO cannot be a charity as defined in the Income Tax Act. A CRA ban prohibits both of these organizations from benefiting their memberships using revenue.

Do Nonprofits Pay Taxes In Canada. Under the Act a charity can apply to the Canada Revenue Agency for registration. There are no income taxes owed by charities and nonprofit organizations alike.

Distinguishing a non-profit organization from a charity. Church and religious organizations in Canada are not included in the federal income tax lawDepending on whether the tax exemptions continue and the fact that churches are not covered by any tax classes Bell wondered how much the churches would. Instead of filing a tax return under the Income Tax Act non-profit organizations must file the Form T1044.

These organizations dont have to pay income tax. It is not necessary to pay property taxes to get nonprofit services from local governments. Find more information at About alternate format or by calling 1-800-959-5525.

Income Tax Exemption and Tax Treatment of Donations. Under section 149 of the income tax act ita charities with business operations in canada are. Because nonprofits are tax exempt homeowners and for-profit businesses are taxed as if they are helping them provide nonprofit organizations with benefits such as streetlights and police.

Helping Nonprofits Reach New Heights. There are a number of factors that make a nonprofit a more difficult-to-file organization. Yes nonprofits must pay federal and state payroll taxes.

Additional tax incentives encourage canadians to donate particular types of capital property to. Although nonprofit organizations in Canada do not have to pay income taxes they do have to submit their tax returns with the Canada Revenue Agency. Neither exempt from income tax nor from property tax under the Income Tax Act Canada contrary to what appears to be the intention charitable and non-profit organizations often face heavy financial penalties associated with property taxes.

There are many variations in the requirement for nonprofits to file tax returns based on certain elements such as type of business and financial status. NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization Information Return. Even though not-for-profits dont pay income tax the requirement to file a tax return has been in place since 1993 and penalties exist for late filing.

Not-for-profits that are registered charities must file an income statement annually to the Canada Revenue Agency. NPOs and registered charities are not subject to income tax. Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada Revenue Agency.

GSTHST Information for Non-Profit Organizations. Your recognition as a 501c3 organization exempts you from federal income tax. But nonprofits still have to pay employment taxes on behalf of their employees and withhold payroll taxes in accordance with the information submitted on their W4 just like any other employer.

Do Churches In Canada Pay Taxes. Additionally Canada recognizes a statutory list of organizations which are not technically charities but which are treated as such for the purpose of. Non-profit organizations are exempt from tax under Part 1 of the Income Tax Act for the portion of their fiscal period where they meet the requirements to qualify as a non-profit organization.

Canadian Nonprofits Make Tax Receipts Compliant With Canada Revenue Agency S Regulations Nonprofit Blog

How To Start A Non Profit In Canada Ictsd Org

Canada S Nonprofit Sector In Economic Terms

Canadian Incorporation Nonprofit Charity Etc

Sources And Uses Of Incomes In The Nonprofit Sector

How Do Non Profits Make Money In Canada Ictsd Org

Don Nonprofit Organization In Canada Have A Tax Id Ictsd Org

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Maine Budget Proposal Includes Controversial Tax Changes For Large Nonprofits Canadian Call Centre Ivr Web Chat And E Mail Response Solutions Fun Fundraisers Nonprofit Fundraising Non Profit

What Are Nonprofits Called In Canada Cubetoronto Com

Simple Ways To Start A Nonprofit In Canada With Pictures

Do Nonprofits Register For A Tax Id In Canada Ictsd Org

Do Nonprofit Organizations Pay Property Taxes In Canada Ictsd Org

Simple Ways To Start A Nonprofit In Canada With Pictures

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)