tax sheltered annuity plan

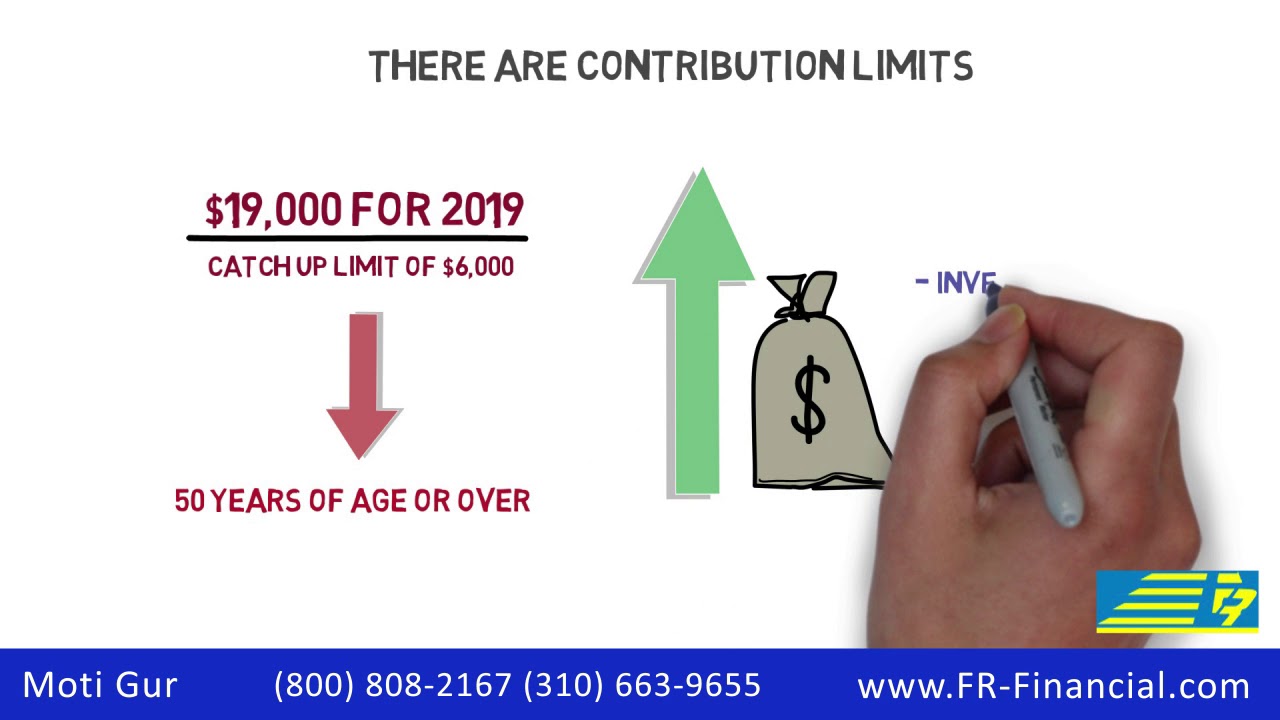

Your annual contribution should not exceed 18 of the previous years earned income. A tax-sheltered annuity plan section 403b plan.

What Is A Tax Sheltered Annuity

We will resume regular business hours on Monday Oct.

. An individual retirement account IRA in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. An annuity can provide you with income that is guaranteed for as long as you live. Treating it as your own.

Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off. Tax-Sheltered Annuity Plans 403b Plans About Publication 575 Pension and Annuity Income. Request to Transfer Qualified Plan to Qualified Plan Tax Forms.

Microsoft describes the CMAs concerns as misplaced and says that. These retirement savings vehicles do provide some tax benefits by letting earnings grow tax-deferred. Form 1040 and 1040-SR Helpful Hints.

Form 1040 and 1040-SR Helpful Hints. A 401k plan is a tax-advantaged retirement account offered by many employers. Statement of required minimum distribution RMD.

Individuals must pay an additional 10 early withdrawal tax unless an exception. TRS offices including the telephone counseling center will be closed for business on Friday Oct. A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain ministers.

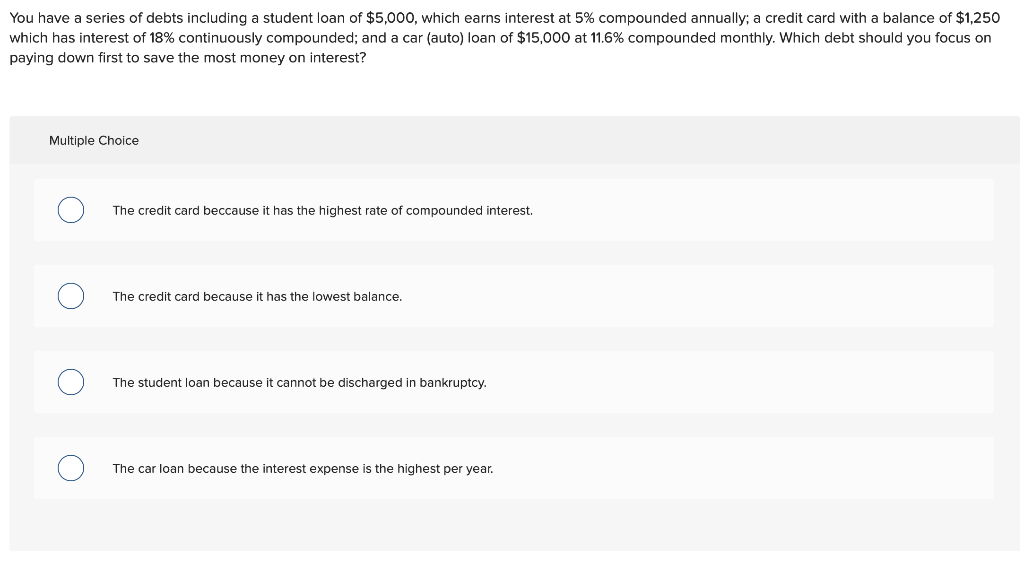

Generally the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called early or premature distributions. A tax-sheltered annuity is a special annuity plan or contract purchased for an employee of a public school or tax-exempt organization. Treat yourself as the beneficiary rather than treating the IRA as your own.

Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax. However at least part of your annuity payments may be subject to federal income taxesThroughout this guide we highlight the different ways the IRS taxes annuities. What Are the Risks of Rolling My 401k into an Annuity.

The contribution limit or maximum amount you can contribute to your RRSP is 27830 for the 2021 tax year and 29210 for 2022. An individual retirement account is a type of individual retirement. 575 Pension and.

It is a trust that holds investment assets purchased with a taxpayers earned income for the taxpayers eventual benefit in old age. Qualified employee annuity plan section 403a plan Tax-sheltered annuity plan section 403b plan or. The General Rule A nonqualified employee plan is an employers plan that doesnt meet Internal Revenue Code requirements.

A deferred compensation plan section 457 plan maintained by a state a political subdivision of a state or an agency or instrumentality of a state or political subdivision of a state. For information about contributions to an IRA see Publication 590-A Contributions to Individual Retirement Arrangements IRAs. Deferred compensation plan of a state or local government section 457 plan.

Understanding 401k Withdrawal Rules. The American Rescue Plan Act of 2021 the ARP enacted on March 11 2021 provides that certain self-employed individuals can claim credits for up to 10 days of paid sick leave and up to 60 days of paid family leave if they are unable to work or telework due to circumstances related to coronavirus. Withdrawal Request - Tax Sheltered Annuity TSA Qualified Charitable Distribution QCD Income Rider Withdrawal Request for BPA Income.

An IRA is a personal savings plan that gives you tax advantages for setting aside money for retirement. Contributions to an employer-sponsored plan can reduce your annual contribution room. For 2021 you will use Form 1040 or if you were born before January 2 1957 you have the option to use Form 1040-SR.

Call 800-366-5463 to speak to a LifeCare Assurance Company customer service representative. Individual accounts in a 403b plan can be any of the following types.

Tax Sheltered Annuities What Are They And Who Are They For

Retirement Savings Tsas Tax Sheltered Annuity Plans North Marion School District Or

What Are Tax Sheltered Investments Types Risks Benefits

Tsa Tax Sheltered Annuities Teacher Savings Retirement Plans

Tax Sheltered Annuity A Term That Should Die Educator Fi

If And When To Borrow From A Qualified Retirement Plan

Retirement Plans Pensions And Annuities

403b Tax Shelter Annuity Plan Basics Youtube

Solved In A Tax Sheltered Retirement Plan Which Of The Chegg Com

403 B Tax Sheltered Annuity Plan Overview Vermillion Financial Advisors Inc

Amazon Com Tax Sheltered Annuity Plans 403 B Plans For Employees Of Public Schools And Certain Tax Exempt Organizations Tax Bible Series 2016 Book 3 Ebook Schaper Alexander Kindle Store

Retirement Nuts Bolts And Pre Tax Accounts Training For Campus Hr Retirement Administrators Ppt Download

Retirement Plans What You Need To Know About 403 B Plans Policy Smart

Tax Sheltered Annuity Faqs Employee Benefits

403 B Tsa Dcp Roth Edina Schools Payroll And Myview

What Are Defined Contribution Retirement Plans Tax Policy Center

:max_bytes(150000):strip_icc()/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)