formula for calculating work in progress inventory

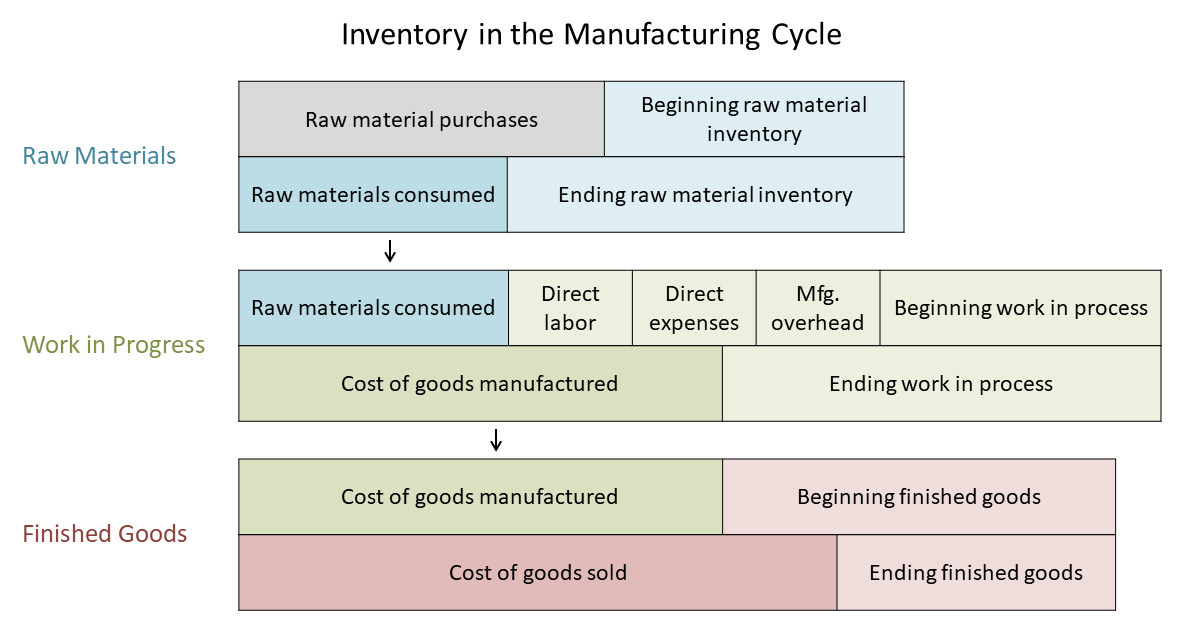

Definition formula and benefits. Deduct the cost of raw material from this figure that is on hand at the end of the accounting period to determine the costs of materials consumed during the accounting period.

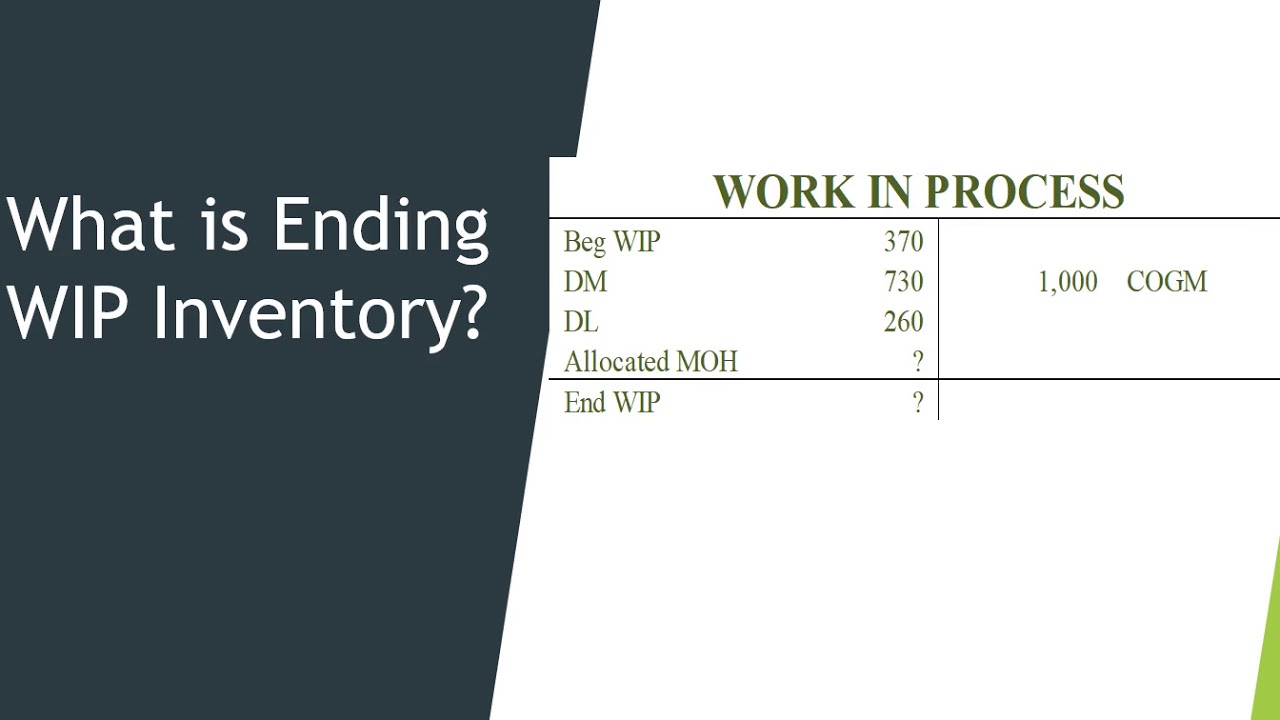

WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS.

. The value of that partially completed inventory is sometimes also called goods in process on the balance sheet particularly if the company is manufacturing tangible items rather than providing services. Calculating Your Work-In-Process Inventory. Formula for calculating work in progress inventory.

To calculate the WIP precisely you would have to manually count each inventory item and determine the valuation accordingly. The calculation to find the work-in-progress inventory at the end of the year is as follows. For example a building expected to have 30 floors and has five.

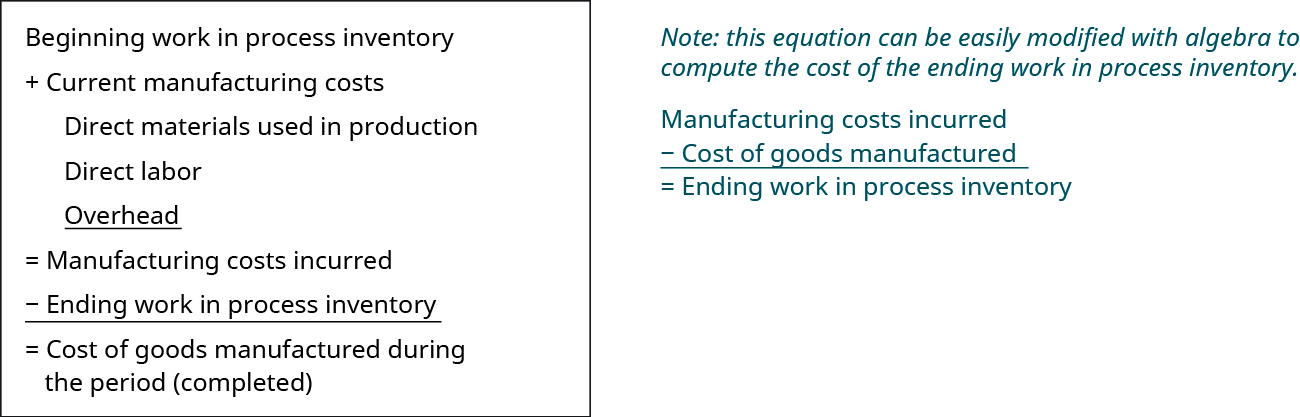

Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. SourceAmerica Has Provided Inventory Management Services For Business For 30 Years. Accounting with Opening and Closing Work-in-Progress-FIFO Method.

Percentage of completion calculations recognize revenue proportionally based on the percentage of completion that is usage total costs vs. This calculation typically includes the cost of raw materials being used a portion of the labor and a portion of the factory overhead to get a good idea of what costs have been covered thus far in production and what. In this case for example consider any manufactured goods as work in process.

Deduct the cost of raw material from this figure that is on hand at the end of the accounting period to determine the costs of materials consumed during the accounting period. On the other hand work in progress takes time and cannot be termed a current asset as it is not anticipated to be converted into cash soon. The factory overhead costs can be calculated for the accounting period.

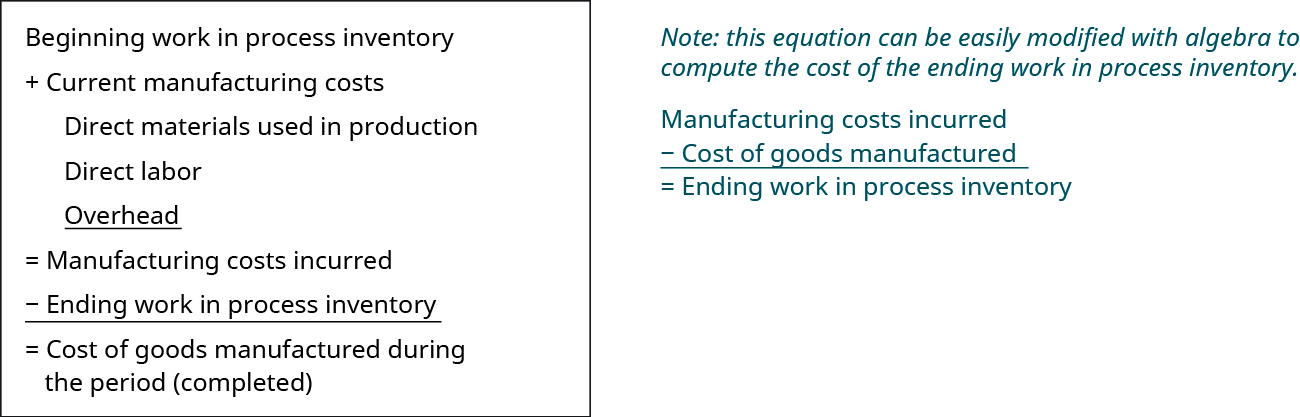

The ending WIP beginning WIP manufacturing costs - cost of goods produced This represents the value of the partially completed inventory which accounts for only a part of what the company will actually produce. Percentage of Completion Usage Total Costs Budget Total Costs. Get all the information related to Work In Process Formula Accounting - Make website login easier than ever.

Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory. As per the Merriam-Webster dictionary Work-in-process WIP refers to a component of a companys inventory that is partially completed. In a product cost estimate with a quantity structure these costs are shown in a separate cost component view.

Order forms payment processing stock management more. Calculating Your Work-In-Process Inventory. 15000 225000 - 215000 25000.

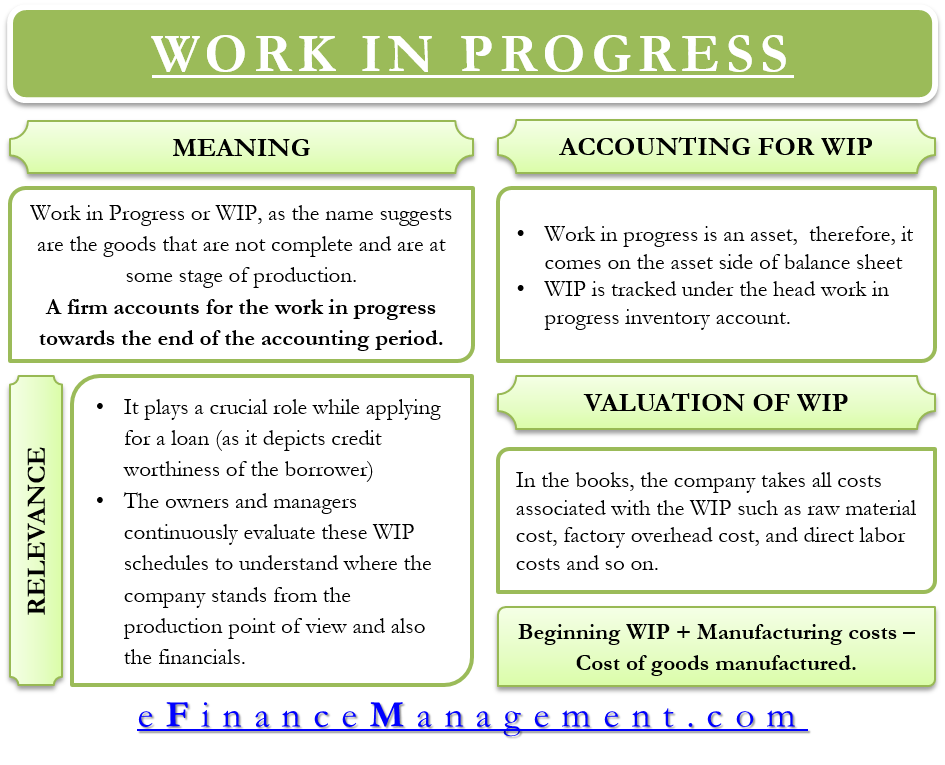

Calculating Work In Progress Inventory The cost estimate used to valuate the work in process may contain costs that are not relevant for inventory valuation such as sales and administration costs. Beginning WIP Manufacturing costs - Cost of goods manufactured. Work in progress inventory or WIP for short refers to the total cost of unfinished goods that are currently in production.

Build an app instead. Abnormal gain- Physical units 100 complete. Referred to as Cost Completion on job task lines WIP Sales Recognized Sales - Billable Invoiced Price.

The formula for calculating WIP inventory is. Used some of its inventory in constructing the work of a building and the inventory was priced at 10000. Formulas to Calculate Work in Process.

The labor costs for the accounting period should be calculated. WIP Inventory Example 2. The Role of Work in Process WIP Inventory in the Supply Cha in.

Although WIP inventory cannot yet be sold its considered an asset on a merchants. Additionally items that are considered work in progress may depreciate or face a lower demand from consumers once they have been completed. Your WIP inventory formula would look like this.

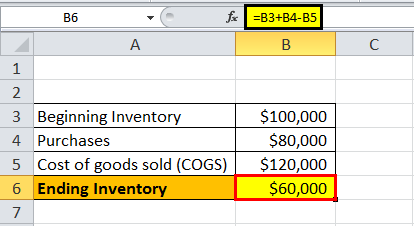

Your WIP inventory formula would look like. During the year 150000 is spent on manufacturing costs along with your total cost of finished goods being 205000. The calculation of ending work in process is.

To calculate your in-process inventory the following WIP inventory formula is followed. Under this method the cost of completed units is calculated by multiplying production expressed in terms of equivalent units. Since WIP inventory takes up space and cant be sold for a profit its generally a best.

As determined by previous accounting records your companys beginning WIP is 115000. Percentage of Work Completed Actual Costs till Date Total Estimated Costs 2 Earned Revenue to Date. Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory.

Additionally its essential that businesses and organizations accurately report costs associated with production for insight into performance and efficiency. Once the period is over and the figure is calculated this number becomes the beginning work in process. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs COGM.

WIP inventory includes the cost of raw materials labor and overhead costs needed to manufacture a finished product. Fortunately you can use the work in process formula to determine an accurate estimate. Tuesday May 17 2022.

On the other hand work in progress is often used in construction and other service businesses and refers to the progress of a project and how much it is costing compared to percentage of completion. Using this WIP formula businesses can calculate how much work in process inventory they will have left over at the end of the accounting period. The formula for the same is.

Ending work in process. WIP is calculated as a sum of WIP inventory total direct labor costs and allocated overhead costs. Abnormal loss- Physical units produced are multiplied by the degree of completion.

In this article well explore what work in process is the formula to calculate work-in-process inventory and how work-in-process differs from work in progress within the production process. Ad Start your free trial stop wasting time on inventory spreadsheets. Work in process WIP inventory refers to materials that are waiting to be assembled and sold.

In this example you would calculate your ending WIP inventory as follows. The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity. The beginning WIP inventory cost refers to the previous accounting periods asset section of the balance sheet.

The calculation to find the work-in-progress inventory at the end of the year is as follows. Ad Start your free trial stop wasting time on inventory spreadsheets. Work In Process.

When these terms are used by businesses selling a physical product both mean the same thing. Ad Contact Us For Warehouse Inventory Management Solutions For Your Business. Here we discuss how to calculate construction work in progress and an example.

What is Work in Process WIP Inventory How to Calculate. Every dollar invested in unsold inventory represents risk.

Ending Inventory Formula Step By Step Calculation Examples

All You Need To Know About Wip Inventory

Cost Of Goods Manufactured Formula Examples With Excel Template

Work In Process Inventory Formula Wip Inventory Definition

Work In Process Wip Inventory Youtube

What Is A Work In Progress Wip 2020 Robinhood

Ending Inventory Formula Step By Step Calculation Examples

How To Calculate Finished Goods Inventory

Work In Progress Meaning Importance Accounting And More

Understanding How Wip Work In Progress Is Calculated In Sap With Example Tech Concept Hub

Work In Progress Wip Definition Example Finance Strategists

What Is Work In Process Wip Inventory How To Calculate It Ware2go

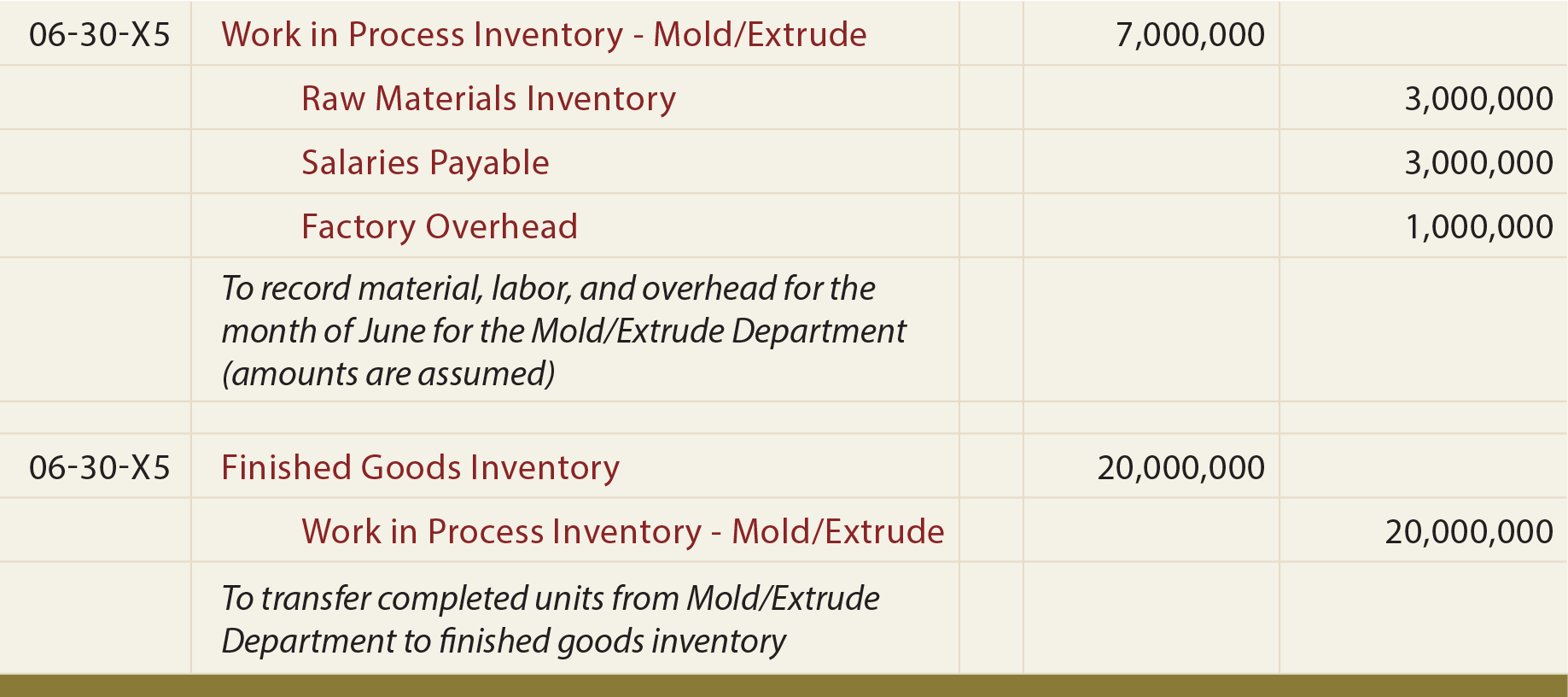

Use The Job Order Costing Method To Trace The Flow Of Product Costs Through The Inventory Accounts Principles Of Accounting Volume 2 Managerial Accounting

Wip Inventory Definition Examples Of Work In Progress Inventory

Cost Allocation To Completed Units And Units In Process Principlesofaccounting Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Sold And The Income Statement For Manufacturing Companies Accounting In Focus